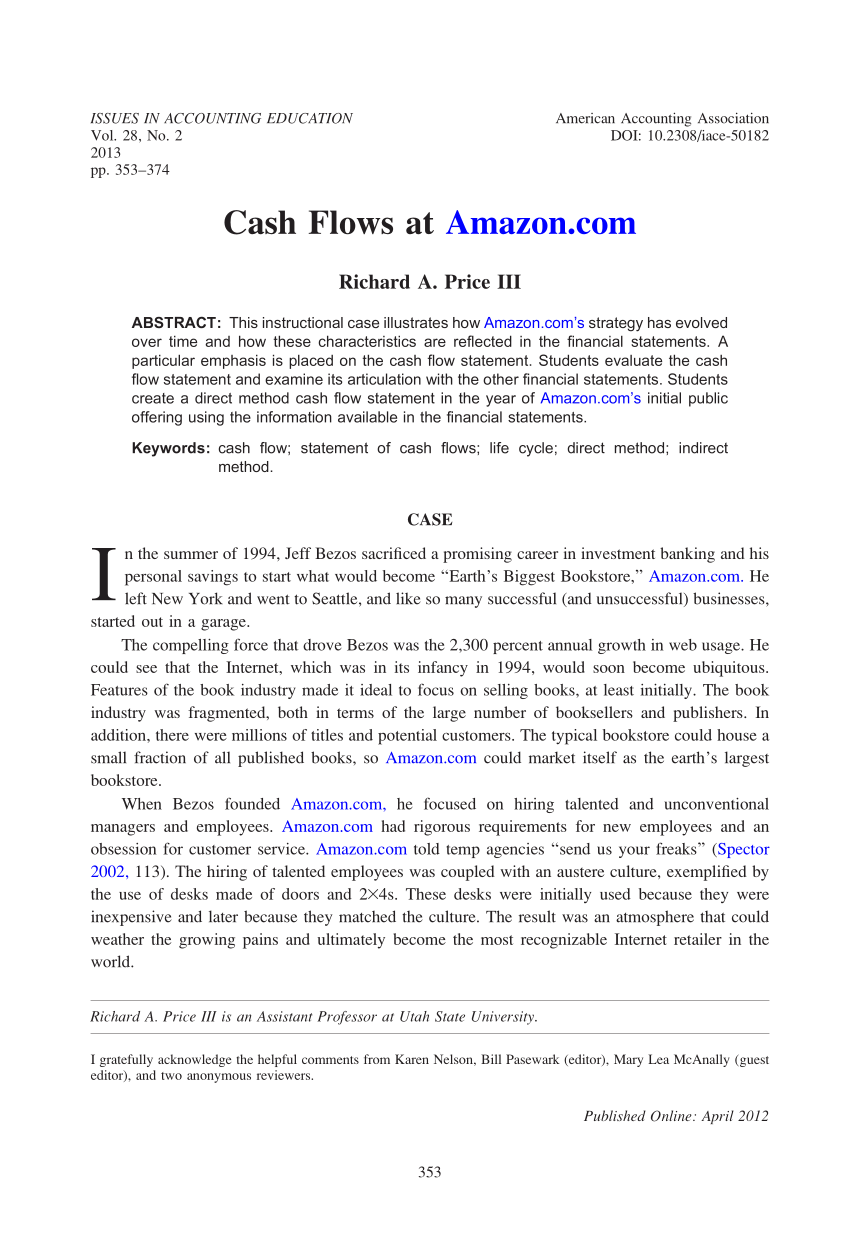

direct vs indirect cash flow gaap

The net income is then. The accuracy indirect method is high due to a lack of any adjustments that are required.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Direct Method both US.

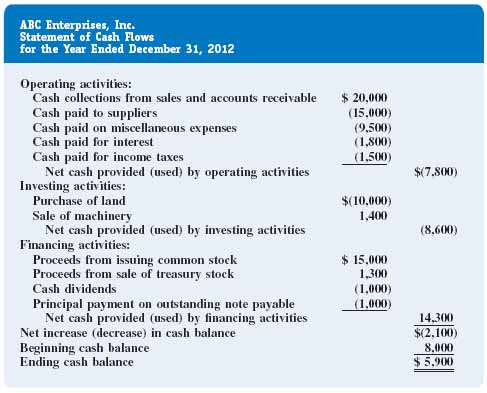

. Its faster and better aligned with the way this accounting. The direct method is particularly useful for smaller business that dont have. Both methods of cash flow analysis yield the same total cash flow amount but the way the information is presented is different.

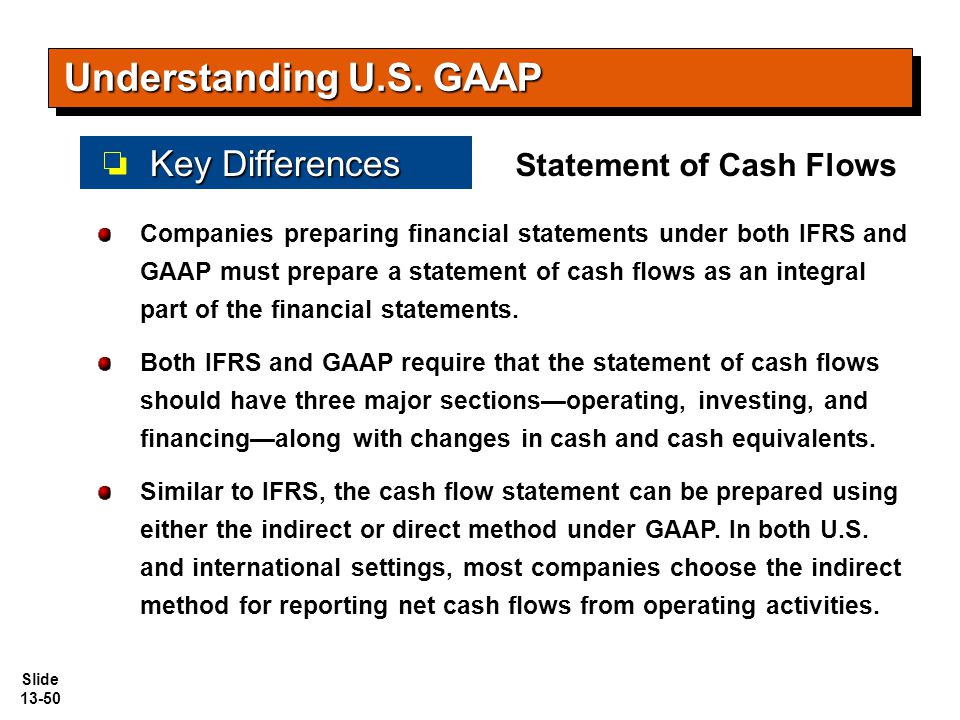

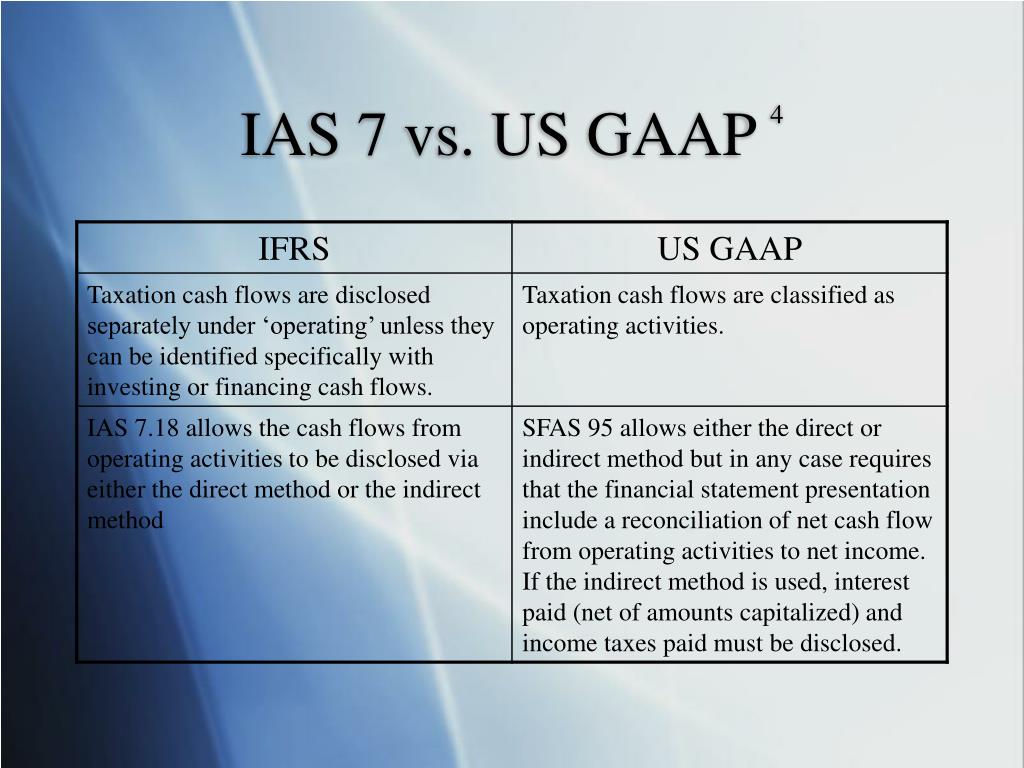

A business cash flow statement shows the companys profits and losses within a given time frame. The indirect method uses accrual. GAAP and IFRS prefer that the operating section of the statement of cash flows be prepared under the direct method.

Non-cash transactions are ignored. 95 permit the direct and the indirect method of. An indirect method has low accuracy since a lot of adjustments to the cash flows are required.

By contrast the indirect method shows only the net effect of items which caused net income and net operating cash flows to differ. Indirect method of cash flow. IAS 7 and Section 230-10-45 FASB Statement No.

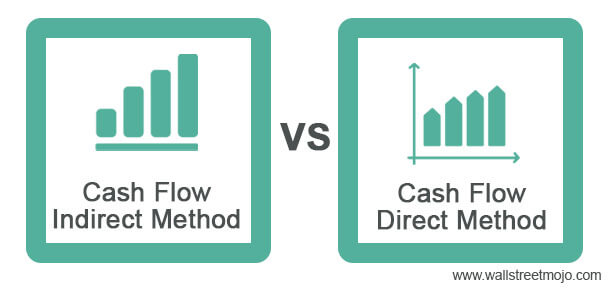

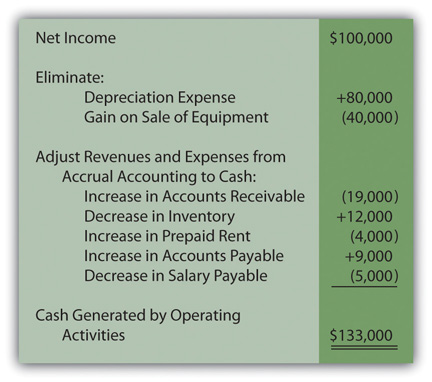

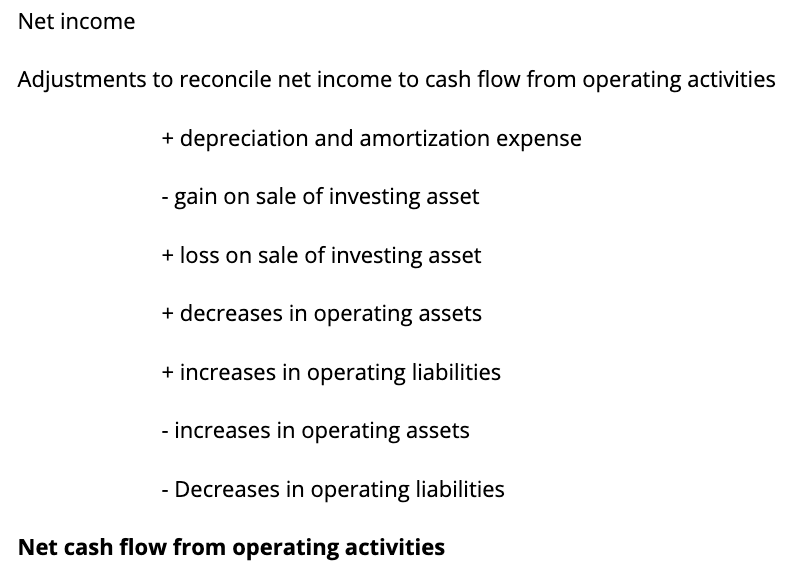

Up to 5 cash back 5412 Comparison with the Reconciliation Method under US. The indirect cash flow method makes reporting cash movements in and out of the business easier for accruals basis accounting. When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income.

Generally the direct method will begin with. Under this method net cash provided or used by operating activities is. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

Direct method vs indirect method The direct method provides information about specific sources and uses of cash but the indirect method shows only the net result. Under the indirect method the calculation of cash flows. The indirect method is a method for creating a statement of cash flows a company may use during any given reporting period.

GAAP requires a reconciliation of net cash. Indirect method is the most widely used method for the calculation of net cash flow from operating activities. The cash flow statement CFS provides information about a companys cash receipts and payments from operating activities investing activities and financing activities.

The indirect method by contrast means reports are often easier to prepare as businesses typically already keep records on an accrual basis which provides a better. The direct method individually itemizes the cash received from your customers and paid out for supplies staff income tax etc.

Direct Vs Indirect The Best Cash Flow Method Vena

Frs 102 Cash Flow Statements Aat Comment

Cash Flows From Operating Activities The Indirect Method

What S The Difference Between Direct And Indirect Cash Flow Methods 365 Financial Analyst

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Statement Of Cash Flows How To Prepare Cash Flow Statements

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

Cash Flow Statement What It Is And Examples

Gaap Vs Ifrs Statement Of Cash Flows Accounting Video Clutch Prep

Chapter 6 Understanding Cash Flow Statements Ppt Download

How To Prepare And Interpret A Cash Flow Statement

The Complete Statement Of Cash Flows Financial Accounting In An Economic Context Book

Direct Method Cash Flow Vs Indirect Method Cash Flow

Cash Flow Statements Examples And Solutions For Your Saas Business Baremetrics

Creating Cash Flow Statements Direct Vs Indirect Cash Flow

Statement Of Cash Flows Ppt Video Online Download

Ppt Ias 7 Statement Of Cash Flows Powerpoint Presentation Free Download Id 5634145